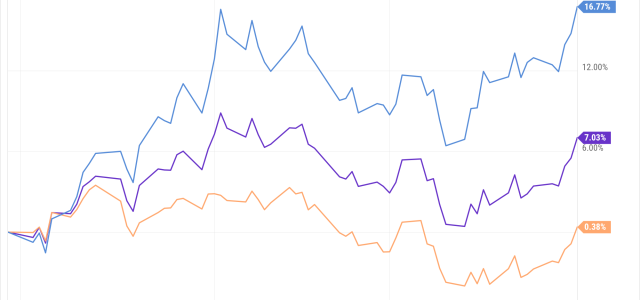

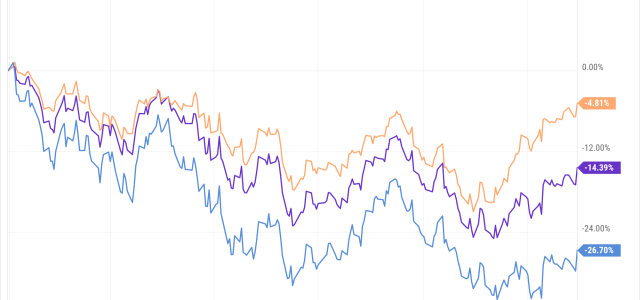

June saw the markets digest the Federal Reserve’s pause in their rate hike regimen after additional evidence indicated that inflation was continuing to

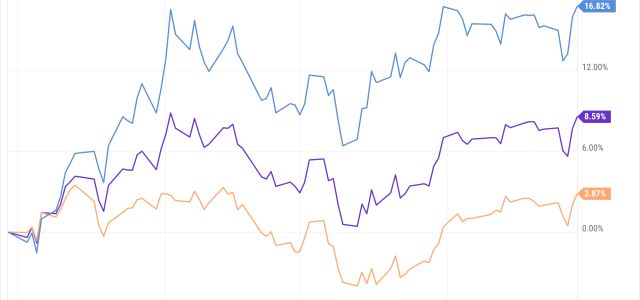

As we look ahead at the Federal Reserve’s May meeting, we expect rate hikes to continue at a muted pace of 25 basis points (or ¼ of one percent). Markets tend

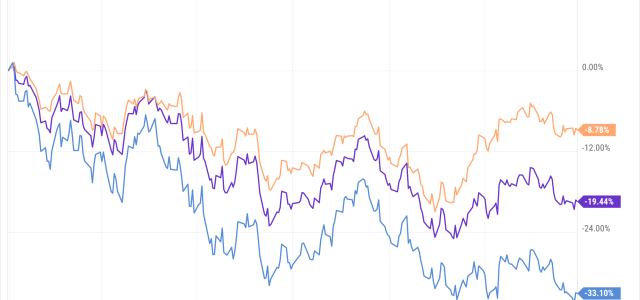

The Federal Reserve’s mistaken assessment of inflation being “transitory” led to a policy of the fastest rate hikes in forty years. It should have been no big

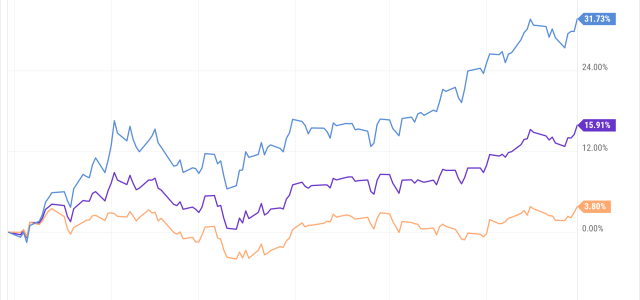

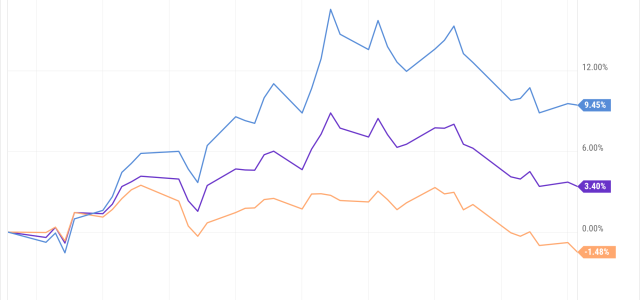

February showed a mixed bag of returns in the equities markets with the technology laden NASDAQ and S&P 500 continuing to have a positive year. The Dow, which

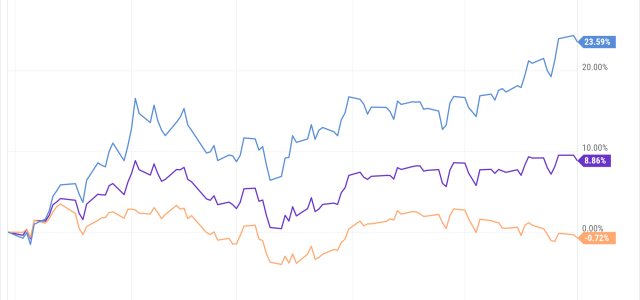

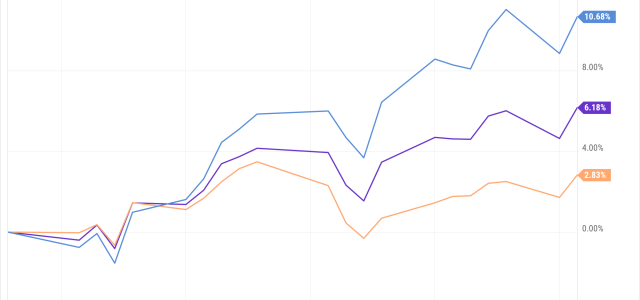

2023 is starting out with several positive tones.

A few supply chain constraints have diminished in late 2022, allowing retailers to shore up their inventories

As we enter the last two months of the year, our thoughts turn to year-end tax planning. If you plan on gifting appreciated stock to taxpayers in zero to low

Despite the improvement in the US consumers’ balance sheets during the pandemic, they are now facing several headwinds. First, spending power is eroded by