August 1, 2023

The economy grew at a 2.0% annualized rate down from a 2.6% pace from the first quarter. Government spending, consumers and exports growth was strong at 5.0%, 7.8% and 4.2% respectively. Gains were offset by a decrease in equipment spending and slowdown in business investment. Tighter lending conditions are leading to strained consumer spending and weaker business investment.

The biggest uptick on the jobs front has been in the government sector with private sector job growth and wage growth moderating significantly. The latest .25% raise in the Fed funds rate bodes well for an additional pause in interest rate hikes by the Federal Reserve at its next meeting on September 20, 2023 although they still have meetings in November and December to make a final .25% tweak that could engineer a soft landing for the economy.

One of the biggest risks facing the economy is in the banking sector where tighter lending standards could pose a drag on future economic growth. Easing supply chains and the reopening of China should boost foreign exports and sales.

The yield on the 10-year Treasury note stands at 3.97%, while the yield on the two-year Treasury dipped to 4.88%.

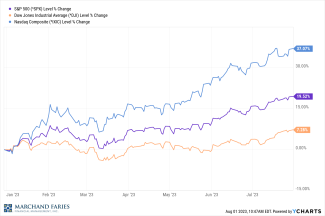

Year to date all the major indices are in the black with the Dow, S&P 500, and NASDAQ at 7.28%, 19.52% and 37.07% respectively.

On September 5th, the TD Ameritrade and Schwab merger will be completed. We will be sending out our performance reports as usual on September 1st.

*Disclaimer: This report is a publication of Marchand Faries Financial Management, Inc. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgement of the author as of the date of publication and are subject to change.