April 1, 2023

The Federal Reserve’s mistaken assessment of inflation being “transitory” led to a policy of the fastest rate hikes in forty years. It should have been no big surprise that this would put stress on the system, and something would inevitably break. The headline was, of course, the collapse of Silicon Valley Bank, the 16th largest bank in the US. SVB’s was a classic case of asset-liability mismatch. SVB securities portfolio was generally made up of very safe bonds and had little credit risk but unfortunately due to the average maturity being so long in these bonds the interest rate risk was significant. Also, SVB’s client base was largely made up of venture capitalists and tech firms, which as higher yielding assets presented themselves moved deposits out of the bank forcing SVB to sell bonds at a significant loss. This situation is generally unusual for most banks who have a broader less herdlike deposit base.

Although the latest increase by the Federal Reserve was just .25, we are still hopeful that a recalibration of the economy is underway. The CPI came in at under 6% for February indicating a slowdown in growth, but still shy of the Fed’s 2% target.

The good news is that the economy seems to be on the right track to slow turn in favor of the Federal Reserve’s objectives; the trick will be to not throw it into a full stop in the process. Equities markets react positively to stability and hopefully we can continue this path through the year.

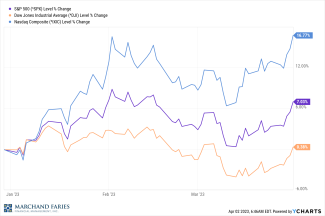

For the first quarter the Dow, S&P 500 and NASDAQ are all positive 0.38%, 7.03% and 16.77% respectively. The yield on the 2-year Treasury’s yield at 4.80% is outpacing the 10-year Treasury which is yielding 3.48%.

*Disclaimer: This report is a publication of Marchand Faries Financial Management, Inc. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgement of the author as of the date of publication and are subject to change.