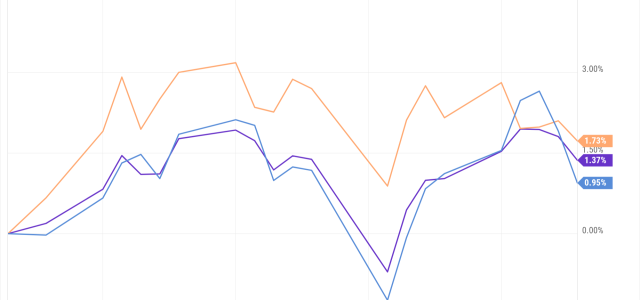

The year 2026 begins with an economic backdrop that remains supportive, with moderation in the employment market and easing inflation creating conditions that

Happy New Year!

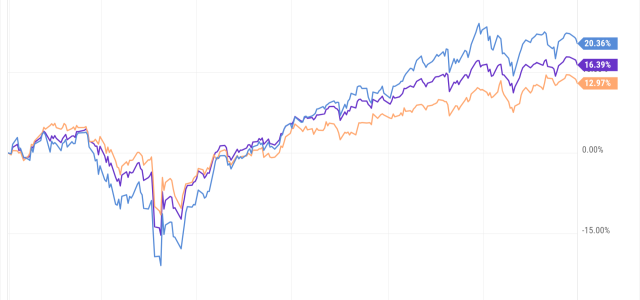

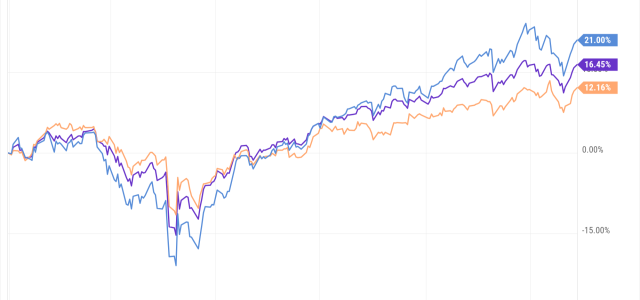

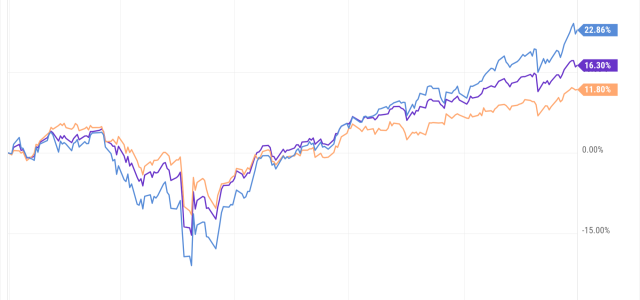

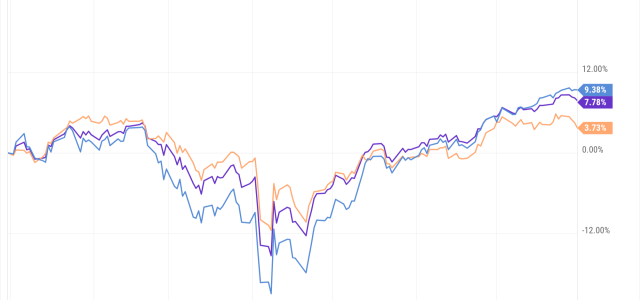

The markets all finished 2025 solidly in the black despite the April dip that occurred as a result of global tariffs. The historically strong

December is a great time for reflecting on the past year while preparing for your continued financial health in the new year. This exercise allows us to

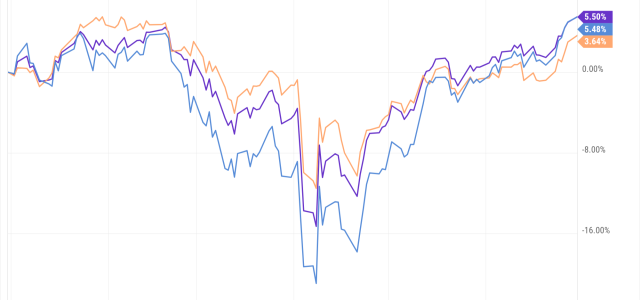

As the government shutdown continues, there are still no immediate prospects for a resolution. One idea floated by both Democrat and Republican voters is not to

This month we are looking at a potential partial government shutdown. Past shutdowns have generally represented a modest impact on economic growth, and little

The markets continue to accelerate with the S&P 500 reaching an intraday high that is triple its lowest point in 2020. The NASDAQ continues to set new highs and

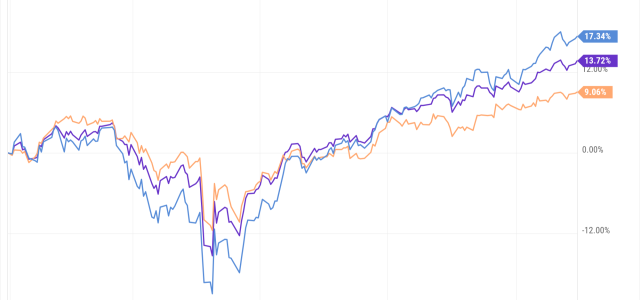

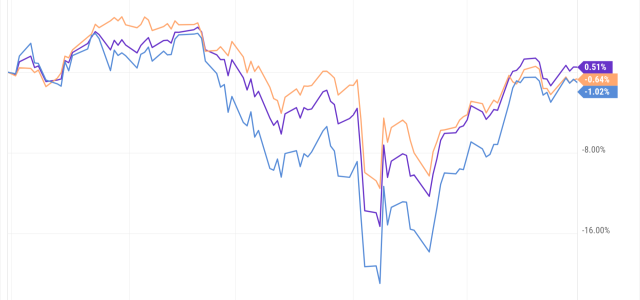

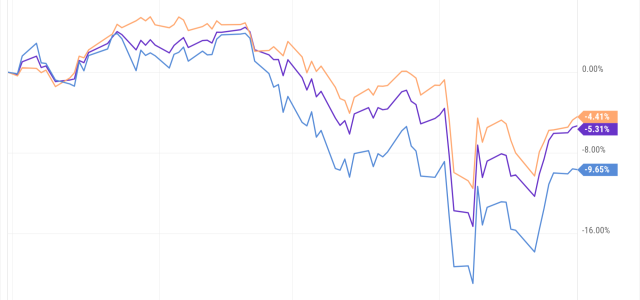

After the dramatic impact of the tariff induced bear market of early April and the corresponding sharp selloff in the markets, earnings forecasts and favorable

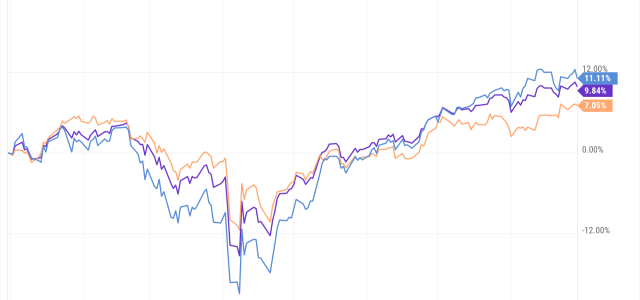

Equity markets have staged an unusually rapid recovery from a tariff induced bear market of early April with easing trade tensions contributing to a nearly 20%

Aside from volatility created by the ongoing tariff negotiations, companies have generally been reporting strong first quarter results for 2025 and more

After more than a decade and a half of bull market returns interrupted only briefly by the pandemic and the onset of the Ukraine War in 2022, long-term