November 1, 2025

As the government shutdown continues, there are still no immediate prospects for a resolution. One idea floated by both Democrat and Republican voters is not to pay Congress during any shutdown.

The Federal Reserve’s announcement to cut interest rates by 0.25% was in line with the market’s expectations. It was based on cooling U.S. labor markets and anchored inflation metrics.

The Federal Reserve faces the complex task of moving toward a neutral policy stance amid elevated uncertainty caused lack of data because of the government shutdown, shifting trade dynamics, and record-high equity markets. We believe this week’s rate cut will be accompanied by cautious guidance through the end of the year, with the Federal Reserve indicating that additional cuts in December are unlikely.

The U.S. economy continues to demonstrate resilience, which reinforces our positive outlook on both public and private corporate fundamentals and relative value opportunities.

As we approach year-end, please let us know of any stock gifts you are considering so that we can submit them for processing well before December 31st.

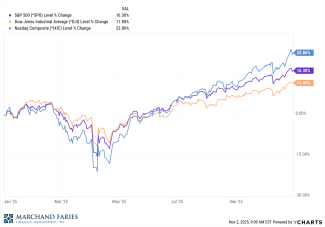

Stocks continue to hit new all-time highs, with the indices achieving record numbers. Year to date, the Dow, S&P 500, and NASDAQ are all in the black with returns of 11.80%, 16.30% and 22.86%, respectively. The yield on the 10-year Treasury note is currently 4.11%, while the yield on the two-year Treasury note is at 3.61%.