January 1, 2026

Happy New Year!

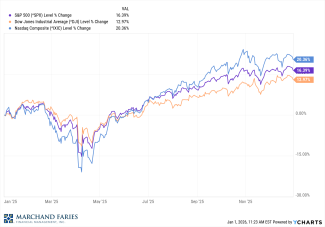

The markets all finished 2025 solidly in the black despite the April dip that occurred as a result of global tariffs. The historically strong “Santa Claus Rally” saw the market dip lower as volumes over the holidays waned, while this stretch has historically seen above average market returns.

International equities had a similarly positive year and are on pace to beat the S&P 500 by more than 10% for the first time since 2007. Technology has been the best performing major sector this year despite its inherent volatility. After putting on an outstanding performance in 2025, both gold and silver moved to new all-time highs in recent weeks.

Looking ahead to 2026, we all know it is never all clear sailing. The biggest risk is that stocks are expensive with the US markets trading above the 90th percentile of its adjusted price/earnings ratio. Rarely have strong markets extended so long as this without a 10% correction or more dramatic pullback. One could argue that the April tariff pullback constitutes a correction, but that was more emotional as opposed to driven by true fundamentals.

For 2025, the markets finished positive with the Dow, S&P 500, and NASDAQ up 12.97%, 16.39%, 20.36% respectively. The 10-year and 2-year Treasuries were at 4.14% and 3.45%.

As the New Year begins, we want to sincerely thank you for the opportunity to work with you and your family. We appreciate the trust you have placed in us, and we wish you a healthy and prosperous 2026!