September 1, 2025

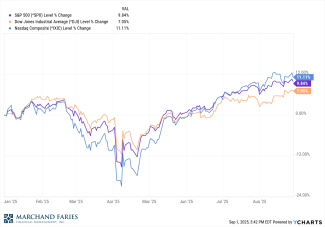

The markets continue to accelerate with the S&P 500 reaching an intraday high that is triple its lowest point in 2020. The NASDAQ continues to set new highs and has nearly quadrupled from its relatively recent lows.

One of the primary tailwinds has been the passage of the One Big Beautiful Bill Act which has extended the 2017 tax cuts. The other major tailwind has come from corporate earnings growth. Eighty-one percent of companies have reported strong earnings and revenue surprises with an average growth rate of 12%. Third quarter earnings estimates are looking at an average of 7% which supports justifying high valuations.

All great news with one caveat; markets always have a period of consolidation, often 10% or more. So, although we celebrate the new highs, we also are realistic in knowing that the markets do fluctuate, sometimes dramatically. We continue to emphasize quality and diversification for long term sustainability.

Both consumer confidence and spending have managed to rebound after retreating in April when the stock market corrected. Since the consumer drives 2/3rds of the economy, healthy spending is a positive sign. Speaking of spending, the Federal Reserve is expected to begin lowering short term interest rates in September, with the first cut being a modest .25 percent. Lower short-term rates help small and midsize companies by making short term loans for expansion more affordable.

Year to date the Dow, S&P 500 and NASDAQ are all positive with year-to-date returns of 7.05%, 9.84% and 11.11%, respectively. The yield on the 10-year Treasury note is currently 4.22%, while the yield on the two-year Treasury note is at 3.62%.