August 1, 2025

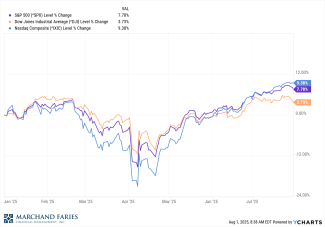

After the dramatic impact of the tariff induced bear market of early April and the corresponding sharp selloff in the markets, earnings forecasts and favorable trade policy negotiations sparked a welcomed and speedy recovery.

Despite the initial shock, the US economy held steady and with trade negotiations with various countries progressing quickly the S&P 500 and NASDAQ began hitting new highs on a daily basis. Rising world tensions and high valuations could see a late summer pullback which is best weathered with a well-diversified portfolio.

As always, should you expect any significant cash needs for the remainder of 2025, an elevated market is the time to consider sales of appreciated assets.

Our opinion is that the economy is slowing but not stalling and some inflation risks remain. We expect the Federal Reserve will lower rates at its meeting in September, but not before. US equities are navigating lofty valuations that are dependent on future earnings and profitability growth which could be enhanced by cheaper borrowing costs of a Fed Funds cut.

Year to date the Dow, S&P 500 and NASDAQ are all ahead with year-to-date returns of 3.73%, 7.78% and 9.38%, respectively. The yield on the 10-year Treasury note is currently 4.38%, while the yield on the two-year Treasury note is at 3.94%.