October 1, 2025

This month we are looking at a potential partial government shutdown. Past shutdowns have generally represented a modest impact on economic growth, and little, if no, long-term impact for markets, which, frankly, really do not care.

Barring some last-minute bipartisan negotiation,the government will enter a partial shutdown just after midnight on Wednesday, October 1, and currently both sides are digging in on their respective positions. Moreover, both sides see some political advantage to holding their ground. Democrats are holding firm on a demand to include an extension of expiring healthcare subsidies to head off a surge in Obamacare-related insurance premiums.

In the meantime, the administration has upped the ante by having federal agencies explore mass firings if the government shuts down, particularly in programs deemed inconsistent with the Republican’s priorities. That raises the stakes not only for the administration’s bid to reshape the government, but for the overall US labor market. The federal workforce has been shrinking this year as part of the overall slowdown in the jobs market. A shutdown could also mean we do not find out whether that slowdown has continued, or whether inflation continues to pick up steam. The Bureau of Labor Statistics would likely delay or altogether halt the release of key data like the jobs report, the Consumer Price Index, and the Producer Price Index. That could mean the Federal Reserve is "flying blind" in a "data desert," ahead of its next meeting. Changing direction in the dark without headlights raises the possibility of an unpleasant surprise down the road. But it could also lower the near-term uncertainty, as no data would dictate sticking to the current roadmap. The bar is high for the Federal Reserve to disregard its own Summary of Economic Projections (SEP) and keep rates unchanged or cut by 50bp in October. A shutdown would make following the already established SEP even more likely, as it would deprive the Fed of a potential rationale for not cutting rates further.

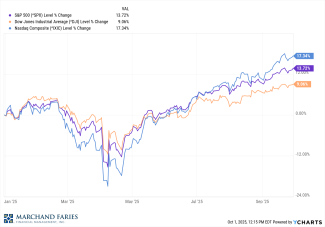

Year to date the Dow, S&P 500 and NASDAQ are all positive with year-to-date returns of 9.06%, 13.72% and 17.34%, respectively. The yield on the 10-year Treasury note is currently 4.15%, while the yield on the two-year Treasury note is at 3.63%.