February 1, 2026

The year 2026 begins with an economic backdrop that remains supportive, with moderation in the employment market and easing inflation creating conditions that allow the Federal Reserve to continue lowering borrowing rates. Economic growth also appears to be strengthening, with fourth-quarter 2025 GDP growth estimated at 5.1%.

According to research from the Federal Reserve Bank of St. Louis, artificial intelligence-related categories contributed approximately 0.97% to real GDP growth. As investment in AI data center infrastructure continues to expand, AI is expected to play an increasingly meaningful role in economic activity over time. However, growth in emerging technologies typically requires sustained investment, and market volatility may create both challenges and opportunities along the way.

Despite ongoing tariff-related uncertainty, inflation remained relatively contained, with consumer prices rising 2.7% in December compared to the prior year. Lower inflation is generally supportive for consumers, who account for approximately two-thirds of U.S. economic growth. In addition, the continued strength in equity markets has contributed to a “wealth effect,” with rising asset values supporting consumer spending through the fourth quarter of 2025 and into early 2026.

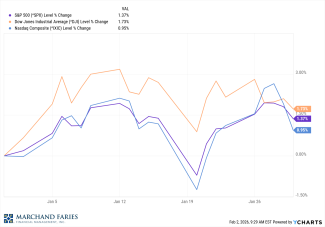

Market performance was positive at the end of January, with the Dow Jones Industrial Average, S&P 500, and NASDAQ finishing the month up 1.73%, 1.37%, and 0.95%, respectively. At month-end, the 10-year and 2-year Treasury yields were approximately 4.24% and 3.53%.

As we move into the early part of the year, you should begin receiving your 2025 Important Tax Information. We recommend gathering these documents in one secure location to ensure they are readily available when needed.