December 1, 2025

December is a great time for reflecting on the past year while preparing for your continued financial health in the new year. This exercise allows us to optimize our budgets, reduce and/or eliminate expenses and debt, minimize taxes, and maximize our retirement savings. All these considerations help you position yourself for continued financial success.

A budget is the foundation of a successful plan, with cash flow being paramount. With a clear and realistic picture of the next 12 months, you can ensure that your financial goals are achievable.

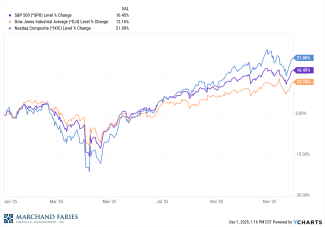

Markets have moved higher on optimism surrounding AI, a move to more accommodative interest policy by the Federal Reserve, and strong earnings growth. Although AI is going to be a factor going forward, it is not currently generating enough revenue or profits to justify infrastructure spending. As a result, the current ups and downs may be a function of market consolidation or the precursor to a correction. Despite the volatile month, all three indices remain positive for the month with year-to-date numbers for the Dow, S&P 500, and NASDAQ ending November up 12.16%, 16.45%, and 21%, respectively.

Interest rates remain at higher-than-expected levels, which holds back consumer spending. Mortgage refinancings have also slowed dramatically. December may see an additional rate cut by the Federal Reserve, which now has more information to work with since the end of the government shutdown. The yield on the 10-year Treasury note is 4%, and the yield on the two-year Treasury note has crept down to 3.45%.

As the year winds down, we want to sincerely thank you for the opportunity to work with you and your family. We appreciate the trust you have placed in us, and we wish you a Merry Christmas and a Happy Holiday Season.