July 1, 2025

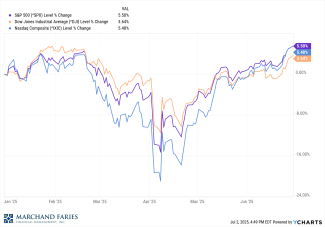

Equity markets have staged an unusually rapid recovery from a tariff induced bear market of early April with easing trade tensions contributing to a nearly 20% rebound from April lows. For those investors who had to sell for various financial obligations like taxes, early April was a tough pill to swallow; and those who bought during that time participated in a welcome and substantial gain.

Uncertainties remain for the economy regarding US trade policy, Federal Reserve interest rate cuts and the conflict in the middle East. However, the US consumer is still resilient, and unemployment numbers are steady in the 4.0 – 4.2% range. So far, consumer prices have defied expectations that tariff-related price increases would flow through to the inflation readings and inflation has come down to 2.4%, slightly higher than the Federal Reserve’s target of 2%.

As the "One Big Beautiful Bill Act" makes its way through congress this week, this significant piece of legislation which was introduced in the 119th Congress is aimed at implementing various budgetary and tax reforms, including tax cuts for middle and working-class families, changes to Medicaid, and increased defense spending. It has been a focal point of political debate, particularly regarding its impact on federal spending and social programs. Of concern to many investors is that several key tax provisions from the Tax Cuts and Jobs Act (TCJA) are set to expire at the end of 2025, including the increased standard deduction, lower individual income tax rates, and caps on state and local tax (SALT) deductions. Additionally, the child tax credit and certain business tax deductions may revert to previous limits starting in 2026. The expiration of these provisions could slow consumer spending and slow the economy significantly.

Year to date the Dow, S&P 500 and NASDAQ all have positive year-to-date returns of 3.64%, 5.5% and 5.48%, respectively. The yield on the 10-year Treasury note is currently 4.24%, while the yield on the two-year Treasury note is at 3.72%.