June 1, 2025

Aside from volatility created by the ongoing tariff negotiations, companies have generally been reporting strong first quarter results for 2025 and more importantly, positive guidance for the remainder of the year. With 90% of the S&P 500 reporting earnings, FactSet had first quarter earnings on pace to grow 13.4%. For 2025 analysts have the remaining quarters’ earnings growing at 5.2%, 7.4% and 6.7%, respectively.

Still, the other uncertainty that remains for corporations is in proposed government policy that could reset tax and spending policies for the next few years. The degree of fiscal stimulus and restraint will be dependent on the “One Big Beautiful Bill” where a slim number have great power to twist the outcome. After what is expected to be a contentious negotiation with Democrat and Republican lawmakers, the final result probably will not be known until mid-July at the earliest.

After being late to get ahead of inflation in 2022, the Federal Reserve’s stance on wait and see, seems appropriate. The rate of inflation has moderated from its high of 9.06% in July 2022 to 2.31% on May 29, 2025. The Federal Reserve’s mandate remains at 2%.

Geopolitical risks remain with some of the biggest conflicts being in Ukraine and Gaza. Taiwan’s independence continues to be threatened by China and new conflicts between India and Pakistan are simmering.

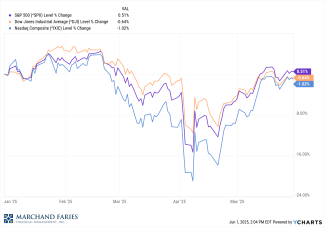

The three indices made a nice recovery in the month of May with the technology laden NASDAQ recovered a whopping 9.56%. The Dow and S&P 500 have a year-to-date return of -0.64% and 0.51% respectively while the NASDAQ is at -1.02%. The yield on the 10-year Treasury note is currently 4.41%, while the yield on the two-year Treasury note is at 3.89%.