May 1, 2025

After more than a decade and a half of bull market returns interrupted only briefly by the pandemic and the onset of the Ukraine War in 2022, long-term investors have looked at declines as buying opportunities. After being up for so long, early 2025 looked vulnerable to the downside, regardless of tariffs.

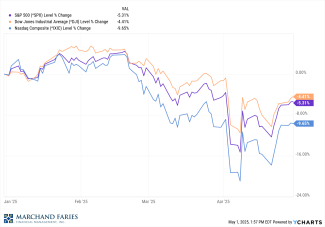

Mid-February the S&P 500 was positive at approximately 4%, almost half the return of a typical year. Following the initial tariff shockwave, equities markets have exhibited some signs of stabilization and recovered some losses, partly supported by subsequent pauses in certain tariffs. The persistent trade tensions and possibility of future escalations continue to foster caution in the near term for stock markets.

Economists debate the short and long-term degree of impact on the economy. Basic economics dictates that tariffs act as a tax. If a tariff is passed onto consumers in the form of higher prices, they cannot use those funds for other purposes, in turn slowing growth. If producers absorb tariffs their profit margins are lower, slowing corporate growth. The long-term effects of tariffs could be the repatriation of various industries providing supply stability and higher employment for a stable economy.

The bottom line is investing quality companies is the key to long-term growth and keeping sufficient liquidity in the form of fixed for current needs is the key to success and peace of mind.

So far for 2025 the three indices are negative with the Dow, S&P 500 and Nasdaq at -4.41%, -5.31% and -9.65% respectively. The current yield on the 10-year Treasury note is currently 4.19%, while the yield on the two-year Treasury note is at 3.65%.