October 1, 2023

Wall Street had a rough September with the major indices slipping approximately 2% for the month.

Stocks struggled to shake off the downbeat mood hanging over markets as investors digested new data on the US economy.

The debate still is around whether the Federal Reserve can manage a "soft landing" for the economy. The latest estimate for second-quarter GDP came in unchanged at 2.1%. Official data showed jobless claims last week rose to 204,000, compared with 215,000 expected. Investors will watch for an update on pending home sales due later.

The Federal Reserve's message that rates will remain higher for longer rattled markets, though stocks are showing some resilience after several days of steep losses. In bonds, the rapid rise in the 10-year Treasury yield continued as it topped 4.6%, trading at levels not seen in over 15 years.

Both markets are under pressure from the surge in the price of oil, which hit fresh 2023 highs on Wednesday and are up over 35% since the end of June. That surge in oil prices is likely to drive up fuel prices, posing a challenge to the Fed's efforts to cool inflation and in turn to the chances of a rate cut.

Oil prices turned lower on Thursday, as West Texas Intermediate futures (CL=F) fell to $92.93 a barrel after topping $95 earlier in the morning. Brent crude futures (BZ=F) were lower at $95.91, having neared $97 in the session.

Rising mortgage rates have weighed heavily on pending home sales in August. As the cost to take out a mortgage increases, more Americans are deciding right now is not the right time to buy a home. The rising rates have drained their purchasing power.

Data just released from the Bureau of Economic Analysis revealed a slightly cooler US economy during the second quarter than initial data showed. The third reading of the second quarter US gross domestic product (GDP) showed the economy grew at an annualized pace of 2.1% during the period, unchanged from the second reading but down from the initial reading of 2.4%. Economists surveyed by Bloomberg had expected the third reading to come in at 2.2%.

Personal consumption growth was revised down to 0.8% from 1.7%, indicating Americans consumed less in the second quarter than previously believed.

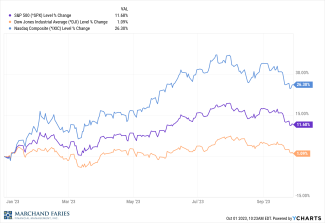

The yield on the 10-year Treasury note stands at 4.59%, while the yield on the two-year Treasury yield is at 5.04%. Year to date all the major indices are still in the black with the Dow, S&P 500, and NASDAQ at 1.09%, 11.68% and 26.30% respectively.

*Disclaimer: This report is a publication of Marchand Faries Financial Management, Inc. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgement of the author as of the date of publication and are subject to change.