November 1, 2021

The often-spooky anniversary of October 19, 1987 has passed, and with that we move toward the seasonably favorable months of November and December. This is happening while earnings are helping support the ongoing bull market. Inflation is the current bogeyman for markets and consumers, with the biggest impact being felt by the 'under and unemployed consumers.' Most long-term investors are in a financial position that is strong enough to withstand the rise in prices for food and fuel. The question is are there enough active participants in the economy with financial resources to sustain future growth?

There were no shortage of risks conspiring to bring the market down a notch, including ongoing federal debt ceiling negotiations in Washington, fiscal policy uncertainty, monetary policy uncertainty (including over whether Federal Reserve Chair Jerome Powell will keep his position), global supply chain bottlenecks, slowing economic and earnings growth projections, and ongoing inflation fears. Ongoing supply chain disruptions are expected to contribute to higher retail prices and in some cases just absence of component parts for finished products.

The transition to the fall season also brought heightened volatility to economic data—as we saw in the recent unexpectedly weak September employment report. Only 194,000 jobs were added to U.S. nonfarm payrolls last month, well below the analyst consensus estimate of 500,000. The rub is that total U.S. payrolls are still five million jobs short of pre-pandemic levels. Additionally, the labor force participation rate ticked down to 61.6% and has moved sideways since last summer. With a large swath of individuals not yet returning to the labor force, employers have faced the mounting challenge of filling open positions. The number of job openings has not only recovered to pre-pandemic levels but surged beyond its 2018 all-time high.

As we approach December, please contact us regarding any year end charitable gifts of stock, so that we can be sure ample time is given for processing.

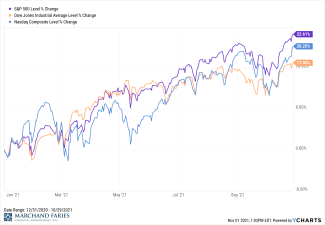

Year to date, the Dow, S&P 500, and NASDAQ are all ahead at 17.03%, 22.61% and 20.25%, respectively, with the yield on the 10-year Treasury at 1.55%.

*Disclaimer: This report is a publication of Marchand Faries Financial Management, Inc. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgement of the author as of the date of publication and are subject to change.